Inheritance

The system of Vesting Inherited Land in the National Treasury will start from April 27 this year

"The system of Vesting Inherited Land in the National Treasury" is a system that allows heirs who have acquired land ownership through inheritance or bequest to relinquish the land to the national treasury.However, in order to use this system, certain requirements must be met.For example, for land, this system cannot be used if there are […]

What is "renunciation of inheritance"?

Renunciation of inheritance means refusing to inherit all of the inheritance including debts.In order to renounce an inheritance, a person must make a statement to the family court within three months from the date on which he or she became aware of the commencement of the inheritance.In the case of inheritance renunciation, unlike qualified acceptance, […]

What is “Qualified Acceptance”?

Qualified acceptance is a system in which the debts of the decedent are inherited to the limit of the property obtained by inheritance.In order to make qualified acceptance, it is necessary to submit an inventory of the inherited property to the family court within three months from the date of knowing the start of the […]

Is the bank account of the deceased frozen when the death certificate is filed?

When a person dies, a death certificate must be filed within 7 days of the date of death.Some people think that filing this death certificate will freeze the deceased person's bank account, but that's not the case.Even if you submit the death notification, the bank will not be contacted by the government office, so the […]

What is an adjudicatio of disappearance?

An adjudicatio of disappearance is a system that has the effect of presuming a missing person to be legally dead.For example, if a family member is missing and it is not clear if he or she is alive or dead, the property of the missing person cannot be disposed of.Also, if the missing person has […]

Points to note when considering renunciation of inheritance

When the decedent dies, the property of the decedent passes to the heirs.However, if the decedent has outstanding debts, the heir will inherit the debts along with the property.Therefore, if there are more debts than assets, only debts will be inherited.In such cases, renunciation of inheritance may be considered.If the inheritance is renounced, the heir […]

Chain successions tax credit

If the mother also dies within 10 years after the father's death, chain successions tax credit are recognized and the inheritance tax is reduced.As a result, an amount equivalent to a certain percentage of the tax amount imposed at the time of inheritance (primary inheritance) upon the death of the father will be deducted from […]

What is the “istributive share reducing request”?

A certain percentage of the inherited property reserved for a certain heir is called a "legally secured portion" and this is a right that cannot be deprived even by a will of the decedent.Civil Code Article 1046 [Claim for Infringement Amount of legally secured portion] stipulates that "The holder of the legally reserved part and […]

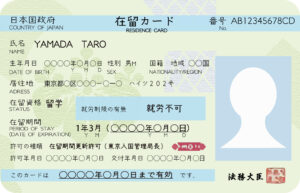

Abandonment of inheritance when a foreign parent or spouse living in Japan dies

Even if a foreigner living in Japan dies and the heir renounces inheritance or accepts a limited inheritance, in principle, the law of the foreigner's home country shall apply.However, if the foreigner lived in Japan until his/her death, or if the heir lives in Japan, it may be possible to renounce inheritance or approve limited […]

Inheritance when a foreigner dies

Article 36 of Japan's "General Rules for the Application of Laws" stipulates that "inheritance shall be governed by the law of the decedent's home country."Therefore, when a foreigner living in Japan dies, the law of the foreigner's home country (country of nationality) will be applied to the inheritance.Therefore, even if the heirs are only a […]