Chain successions tax credit

If the mother also dies within 10 years after the father's death, chain successions tax credit are recognized and the inheritance tax is reduced.

As a result, an amount equivalent to a certain percentage of the tax amount imposed at the time of inheritance (primary inheritance) upon the death of the father will be deducted from the tax amount at the time of inheritance (secondary inheritance) upon the death of the mother.

This chain successions tax credit increases as the interval from the first inheritance to the second inheritance is shorter.

投稿者プロフィール

最新の投稿

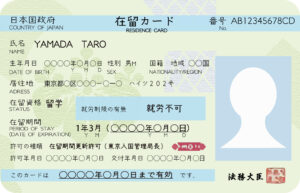

Visa02/26/2024Employers who employ foreigners need to "Notification of foreign employment status".

Visa02/26/2024Employers who employ foreigners need to "Notification of foreign employment status". Visa02/19/2024What kind of Certified Administrative Procedures Legal Specialist should I consult?

Visa02/19/2024What kind of Certified Administrative Procedures Legal Specialist should I consult? Business Manager02/12/2024For those who are considering obtaining the “Business Manager” status of residence

Business Manager02/12/2024For those who are considering obtaining the “Business Manager” status of residence Specified Skilled Worker02/05/2024To companies who are suffering from labor shortage

Specified Skilled Worker02/05/2024To companies who are suffering from labor shortage