Lump-sum Withdrawal Payments from Pension Insurance for Foreigners Who Worked in Japan

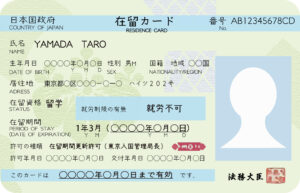

Foreigners working in Japan are supposed to join either the employee's pension or the national pension, depending on the type of company they work for.

If you have paid premiums for 10 years (120 months) or more, you can receive a certain amount of this pension when you reach the age of 65.

However, if you return to your home country without fulfilling the pension eligibility, you can apply for a lump-sum withdrawal payment if you meet all of the following requirements.

- The person does not have Japanese nationality

- The person has been insured for 6 months or more

- The person has not fulfilled the eligibility period for an old-age pension

- The person has never had the right to receive a disability pension or other pension.

- The person does not have an address in Japan

- Two years have not passed since the person last lost eligibility as an insured person under the public pension system.

Please note that you cannot receive this Lump-sum Withdrawal Payment unless you request it.

投稿者プロフィール

最新の投稿

Visa02/26/2024Employers who employ foreigners need to "Notification of foreign employment status".

Visa02/26/2024Employers who employ foreigners need to "Notification of foreign employment status". Visa02/19/2024What kind of Certified Administrative Procedures Legal Specialist should I consult?

Visa02/19/2024What kind of Certified Administrative Procedures Legal Specialist should I consult? Business Manager02/12/2024For those who are considering obtaining the “Business Manager” status of residence

Business Manager02/12/2024For those who are considering obtaining the “Business Manager” status of residence Specified Skilled Worker02/05/2024To companies who are suffering from labor shortage

Specified Skilled Worker02/05/2024To companies who are suffering from labor shortage