To avoid succession proceedings

After the decedent passes away, each heir will inherit the property after going through the inheritance procedures.

However, in the case of an elderly couple living alone, it is difficult for the surviving spouse to carry out inheritance procedures, so some people are wondering if there is a way to simplify it.

There is a “Testamentary Substitute Trust” as a method that can be used in such a case.

A “Testamentary Substitute Trust” is a contract in which you entrust your property in trust, with you as the primary beneficiary, your spouse as the secondary beneficiary, and a trust bank, etc. as the trustee.

This allows you to pass your property to your spouse, who is the second beneficiary, without going through inheritance procedures after you die.

However, if there are multiple heirs and the contract infringes on the legally reserved portion, it will be subject to a claim for the amount of infringement on the legally reserved portion later, so be careful.

投稿者プロフィール

最新の投稿

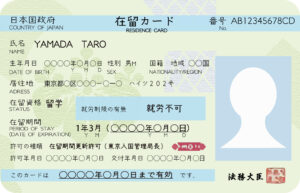

Visa02/26/2024Employers who employ foreigners need to "Notification of foreign employment status".

Visa02/26/2024Employers who employ foreigners need to "Notification of foreign employment status". Visa02/19/2024What kind of Certified Administrative Procedures Legal Specialist should I consult?

Visa02/19/2024What kind of Certified Administrative Procedures Legal Specialist should I consult? Business Manager02/12/2024For those who are considering obtaining the “Business Manager” status of residence

Business Manager02/12/2024For those who are considering obtaining the “Business Manager” status of residence Specified Skilled Worker02/05/2024To companies who are suffering from labor shortage

Specified Skilled Worker02/05/2024To companies who are suffering from labor shortage